Call Toll Free

833-414-7233

Month: June 2020

After losing ground in 2018, U.S. stocks had a banner year in 2019, with the S&P 500 gaining almost 29% — the highest annual increase since 2013.1 It’s too early to know how 2020 will turn…

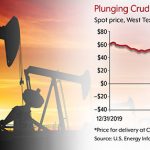

READ MORE >On April 20, 2020, the price of a futures contract for West Texas Intermediate crude — the benchmark for U.S. oil prices — fell below zero for the first time in history, dropping more than…

READ MORE >An annuity is an insurance contract that offers an income stream in return for one or more premium payments. Income payments continue for the duration of the contract, which may be for life or a…

READ MORE >