Month: July 2020

Businesses are responsible for paying payroll taxes for Social Security, Medicare, and unemployment for their employees, but not for independent contractors. And when using contract workers, employers avoid related expenses such as workers’ compensation insurance…

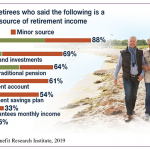

READ MORE >Each year, the Employee Benefit Research Institute (EBRI) surveys workers and retirees to assess how confident they are in their ability to live comfortably throughout retirement. In 2019, only 67% of workers reported feeling “very”…

READ MORE >The Setting Every Community Up for Retirement Enhancement (SECURE) Act was enacted in December 2019 as part of a larger federal spending package. This long-awaited legislation expands savings opportunities for workers and includes new requirements…

READ MORE >You may already have insurance to help support your family financially if you should pass away. But could your small business benefit from additional life insurance that would protect your employees, business partners, and their…

READ MORE >