Category: Savings

With the potential for tax-free retirement income, Roth IRAs may be appealing investment vehicles. There are three ways to fund a Roth IRA — you can open an account and contribute directly, you can convert…

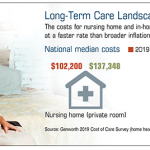

READ MORE >Life insurance has many uses, including income replacement, business continuation, and estate preservation. Long-term care insurance helps provide financial protection against the potentially high cost of long-term care. If you find yourself in need of…

READ MORE >Are health insurance premiums taking too big of a bite out of your budget? Do you wish you had better control over how you spend your health-care dollars? If so, you may be interested in…

READ MORE >Outstanding student loan debt in the United States is currently estimated at over $1.6 trillion dollars — a figure that includes both federal and private student loans. Student loan debt is now the second-highest consumer…

READ MORE >Chances are, your retirement income will come from a variety of sources, which will need to be thoughtfully and carefully combined like pieces of a puzzle. Let’s take a look at some of the more…

READ MORE >A successful nest egg builder maximizes gain and minimizes loss. Though there can be no guarantee that any product or a financial instrument will be successful. There is always a risk, including the possible loss…

READ MORE >You know how important it is to plan for your retirement, but where do you begin? One of your first steps should be to estimate how much income you’ll need to fund your retirement. That’s…

READ MORE >The Setting Every Community Up for Retirement Enhancement (SECURE) Act was enacted in December 2019 as part of a larger federal spending package. This long-awaited legislation expands savings opportunities for workers and includes new requirements…

READ MORE >An annuity is an insurance contract that offers an income stream in return for one or more premium payments. Income payments continue for the duration of the contract, which may be for life or a…

READ MORE >Being named as the executor of a friend’s or family member’s estate is generally an honor. It means that person has been chosen to handle the financial affairs of the deceased individual and is trusted…

READ MORE >