Estate Planning & Designated Beneficiaries

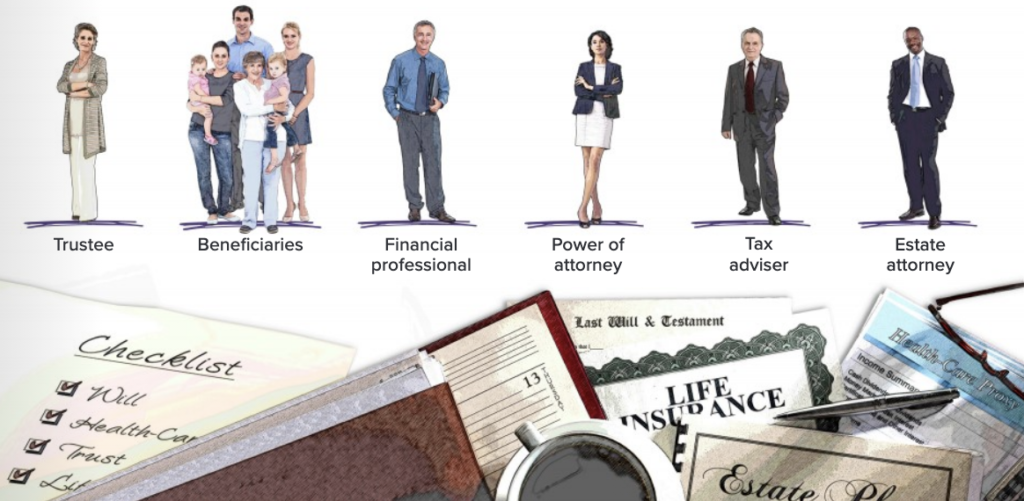

People and Papers When Creating An Estate Plan

To develop a comprehensive plan, you will need certain key documents and the guidance of a professional team. The advisors you choose and the documents you require may vary with your specific situation. These are some of the “people and papers” typically involved in the estate planning process. Naturally, you must give careful thought to your beneficiaries — family, friends, and/or charitable organizations. After all, the estate conservation plan is ultimately for their benefit.

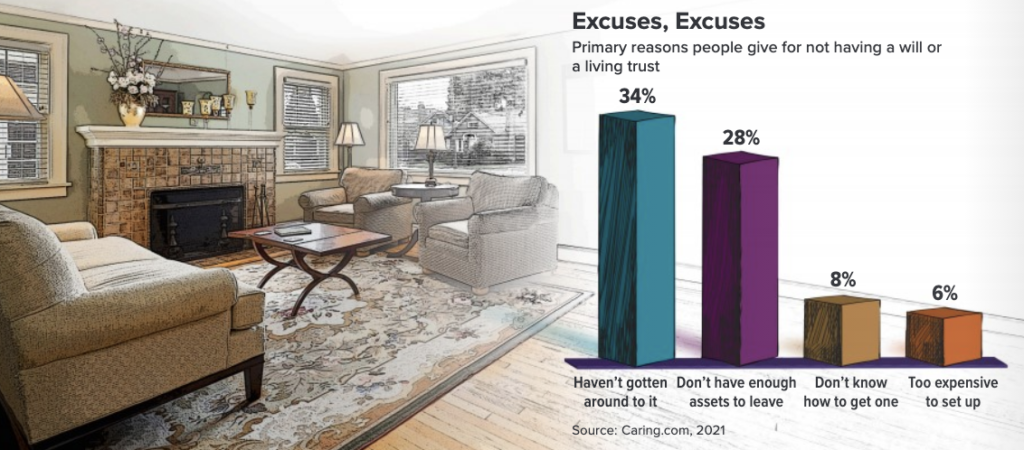

Where There’s a Will

A will enables you to specify how your assets should be distributed and to name the executor who will administer your estate. In general, it is better to name a single executor, with a contingent executor if the named executor is unable to carry out his or her duties. Be sure to discuss your wishes with your executor. You can also use your will to designate guardians for minor-age children or adult children with special needs. If you die intestate (without a valid will), the state could decide how your assets will be distributed. Typically, assets would go to the surviving spouse and children, but state laws and distribution formulas vary. When the deceased dies intestate and leaves no spouse or children, the situation becomes more complicated.

Do You Know Your Beneficiaries?

In general, the beneficiaries named in your last will and testament will inherit items you designate for them. However, with certain types of contracts — including most retirement accounts and insurance policies — the beneficiary designation form typically supercedes any bequest in your will. It’s important to carefully consider the people you name on all beneficiary forms and resolve any conflicts with the beneficiaries named in your will.

Here are some key considerations regarding beneficiary designations:

- Your current spouse must be the beneficiary of an employer-sponsored retirement plan unless he or she waives that right in writing. If there is no spousal waiver, any children from a previous marriage might not receive the account proceeds you want them to have.

- It is wise to designate secondary or contingent beneficiaries in the event that the primary beneficiaries predecease you. Otherwise, proceeds will be distributed according to the default method specified in the account documents and/or state law.

- Some insurance policies, pension plans, and retirement accounts may not pay death benefits to minors. If you want to leave money to young children, you should designate a guardian or a trust as beneficiary.

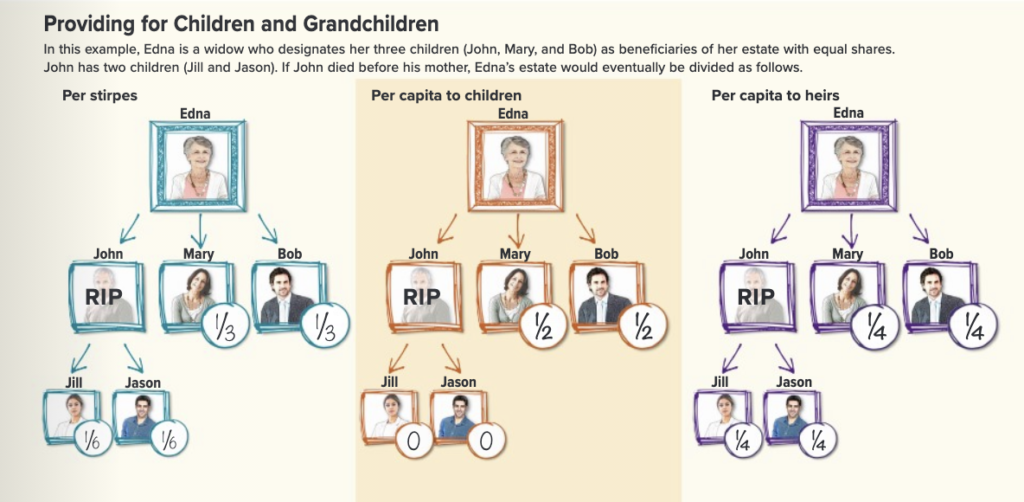

In documents naming beneficiaries, you may see the Latin terms per stirpes and/or per capita. These terms refer to the way assets are distributed if a named beneficiary passes away before you do.

Per stirpes (also called “by representation”) literally means by the roots, but it might be clearer to imagine the branches of the family tree. If one of your beneficiaries predeceases you, his or her share would be divided proportionately among his or her heirs upon your death.

Per capita literally means by the head, indicating equal shares for each member of a group. If one of your beneficiaries predeceases you, the division of assets would depend on how you defined the group of heirs. For example designating to my children per capita would produce a very different distribution than designating to my heirs (or issue) per capita.

I believe in planning for your family. So, let me help guide you through that process.

Photos here include my grandson & great-grandbaby!

Schedule a no-obligation consultation with me today.

https://calendly.com/freeman-7/free-consultation