The High Cost of Late Life Student Debt

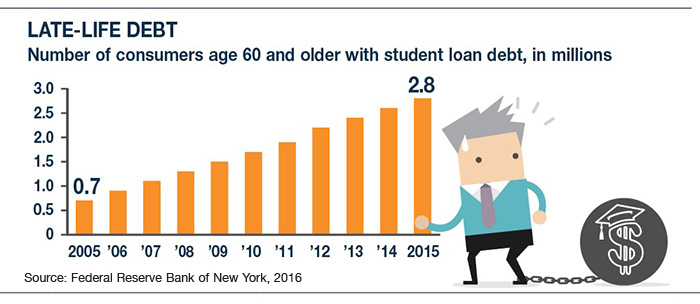

Normally, it’s recent college graduates or young professionals that complain about the burden of student debt. However, the number of consumers age 60 and older with student loan debt quadrupled from 2005 to 2015 (see chart). During this period, the average amount owed by those 60 and older rose from $12,100 to $23,500.1

Repaying student debt can make it more difficult to save for retirement. Student loan borrowers who are 50 to 59 have lower retirement account balances than those without such loans. In 2015, 29% of loans by borrowers age 50 to 64 were in default, compared with just 17% for those under 50. For borrowers who are 65 or older, the default rate was even higher at 37%.2 If you have student debt or are considering a higher-education loan, here are some factors to keep in mind:

1. Federal Offsets

The federal government can withhold all or part of a tax refund and up to 15% of monthly Social Security benefits to pay back defaulted federal student loans.3(These federal “offsets” do not apply to private student loans, but private debt collectors may threaten to take such action.) Unlike some forms of loans, student debt is not dischargeable through standard bankruptcy proceedings.

2. Student Debt Payment Considerations

Federal student loans offer a variety of income-based repayment plans, but it’s important to make sure you are enrolled in the appropriate plan if your income changes, such as when you shift into retirement. Borrowers of Parent PLUS loans, designed specifically for parents, are eligible for a limited income-based repayment plan, but the student debt must be converted to a federal consolidation loan.

When making payments for a student who has multiple loans that have not been consolidated — for example, if you co-signed a loan for a student who has other loans under his or her name — make sure that your payments are being applied to the appropriate loan in order to preserve your own credit.

3. Think About Your Own Future

Although some older Americans still carry debt from their own education or a spouse’s education, almost three out of four student loan borrowers age 60 and older carry loans for children or grandchildren.4 Many parents feel a deep sense of responsibility to help put their children through college. But it’s also important to focus on your own financial future and maintain a consistent and realistic retirement strategy.

Sources:

1–2, 4) Consumer Financial Protection Bureau, 2017

3) U.S. Government Accountability Office, 2016

There are no scholarships to help pay for retirement.

I know you may have strong feelings about putting your children or grandchildren through college. But, there may be other solutions available to you.