Category: Social Security

Planning your retirement income is like putting together a puzzle with many different pieces. One of the first steps in the process is to identify all potential income sources and estimate how much you can…

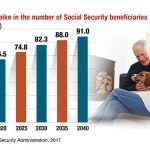

READ MORE >Social Security benefits could be a key component of your retirement strategy. You may want to consider how your claiming age could affect the size of your benefit. Age 62 — You will receive a…

READ MORE >The IRS uses your “combined income” to determine taxability of benefits. If your income exceeds certain income thresholds, you may owe federal income tax on up to 50% or 85% of your Social Security benefits….

READ MORE >The Bipartisan Budget Act of 2015 made some changes to the rules for claiming retirement and spousal benefits. Deemed Filing New rules: Deemed filing now applies to everyone, even those who are full retirement age…

READ MORE >The COVID-19 recession and the continuing pandemic pushed many older workers into retirement earlier than they had anticipated. A little more than 50% of Americans age 55 and older said they were retired in Q3…

READ MORE >Know how inflation can impact your savings. Inflation is the increase in the price of products over time. Inflation rates have fluctuated over the years. Sometimes inflation runs high, and other times it is hardly…

READ MORE >When did you last review your Social Security benefits? Your Social Security Statement provides important information about your Social Security record and future benefits, including a projection of your retirement benefits at age 62, full…

READ MORE >