Year: 2018

Daily life is full of numbers, and some matter more than others. Here are four financial numbers that could help you understand and potentially improve your financial situation. 1. Retirement Plan Contribution Rate What percentage of…

READ MORE >Investing in your own business makes sense. Many businesses achieve significant growth each year. However, when you consider that many small businesses fold every year, it becomes clear that banking your retirement solely on the…

READ MORE >A 403(b) plan is a special tax-deferred retirement savings plan that is often referred to as a tax-sheltered annuity, a tax-deferred annuity, or a 403(b) annuity. It is similar to a 401(k), but only the…

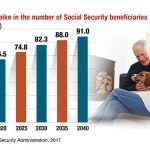

READ MORE >When did you last review your Social Security benefits? Your Social Security Statement provides important information about your Social Security record and future benefits, including a projection of your retirement benefits at age 62, full…

READ MORE >Birthdays may seem less important as you grow older. They may not offer the impact of watershed moments such as getting a driver’s license at 16 and voting at 18. But beginning at age 50,…

READ MORE >A spousal IRA — funded for a spouse who earns little or no income — offers an opportunity to help keep the retirement savings of both spouses on track. It also offers a larger potential…

READ MORE >Normally, it’s recent college graduates or young professionals that complain about the burden of student debt. However, the number of consumers age 60 and older with student loan debt quadrupled from 2005 to 2015 (see…

READ MORE >Should you pay off debt or save for your employer-sponsored retirement fund? That’s a very good question and one that does not have easy answers. For one person, they may need to pay off debt. Another…

READ MORE >