Category: Longevity

Planning your retirement income is like putting together a puzzle with many different pieces. One of the first steps in the process is to identify all potential income sources and estimate how much you can…

READ MORE >People and Papers When Creating An Estate Plan To develop a comprehensive plan, you will need certain key documents and the guidance of a professional team. The advisors you choose and the documents you require…

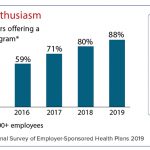

READ MORE >Are health insurance premiums taking too big of a bite out of your budget? Do you wish you had better control over how you spend your health-care dollars? If so, you may be interested in…

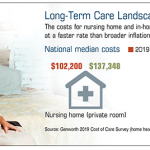

READ MORE >1. What is long-term care? Long-term care refers to the ongoing services and support needed by people who have chronic health conditions or disabilities. There are three levels of long-term care: Skilled care: Generally round-the-clock…

READ MORE >Estate planning is the process of managing and preserving your assets while you’re alive, and conserving and controlling their distribution after your death. There are four key estate planning documents most everyone should have, regardless…

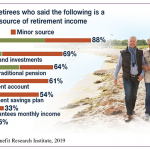

READ MORE >Each year, the Employee Benefit Research Institute (EBRI) surveys workers and retirees to assess how confident they are in their ability to live comfortably throughout retirement. In 2019, only 67% of workers reported feeling “very”…

READ MORE >An annuity is an insurance contract that offers an income stream in return for one or more premium payments. Income payments continue for the duration of the contract, which may be for life or a…

READ MORE >Widespread smartphone use, loosening regulations, and employers seeking health cost savings are three trends that were driving the rapid expansion of telemedicine. And that was before social distancing guidelines to help control the spread of…

READ MORE >Many Americans realize the importance of saving for retirement, but knowing exactly how much they need to save is another issue altogether. With all the information available about retirement, it is sometimes difficult to decipher…

READ MORE >Know how inflation can impact your savings. Inflation is the increase in the price of products over time. Inflation rates have fluctuated over the years. Sometimes inflation runs high, and other times it is hardly…

READ MORE >