Life Insurance Strategies

Life insurance could play an important role in your wealth-preservation strategy.

Although many people allow their life insurance policies to lapse as they get older,

there are good reasons to maintain coverage.

The most obvious reason, of course, is to provide for your spouse and others who depend on you. If the day-to-day needs of your loved ones are taken care of, you may want coverage to provide liquidity and potentially increase the value of your estate.

Covering Costs

A life insurance policy could help pay any taxes or other liabilities due on your estate. But even if your estate is not subject to taxes, end-of-life costs — medical expenses, legal costs associated with tying up financial affairs, and other final expenses — could be a burden for your heirs. Unlike some assets, life insurance death benefits are typically paid relatively quickly, and an insurance death benefit is usually not subject to federal income tax. A relatively modest life insurance policy could be a big help during a difficult time.

Last-Survivor Policy

Unlike traditional policies, a last-survivor life insurance policy insures two or more individuals (often a married couple), with the beneficiaries often being children or other heirs. Because the policy pays the benefit only after the death of the last-surviving insured party, the premiums are often lower for a last-survivor policy than they would be for the cost of two individual policies.

Life Insurance Trust

If you anticipate that your assets may be subject to federal and/or state estate or inheritance taxes, you might consider an irrevocable life insurance trust (ILIT). An ILIT could keep insurance policy proceeds out of the taxable estate and provide ready cash to help pay taxes on any estate assets that exceed the exemption amount. You would fund the ILIT, and the trustee would use the money to purchase a life insurance policy that is owned and controlled by the trust. Typically, you would gift additional money to the trust each year, and the trustee would use the money to pay premiums on the policy. When you (the insured) die, the life insurance proceeds are paid to the trust, and the trustee distributes the proceeds according to the terms of the trust. Keep in mind that once the ILIT is created, you cannot change the terms or beneficiaries of the trust, and you must give up control of the life insurance policy. People insured under policies owned by the trust cannot serve as a trustee. All life insurance premiums must be paid by the trust.

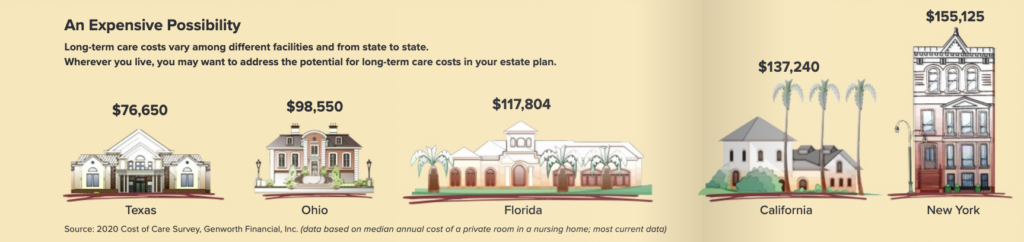

Long-Term Care

Long-term care may be needed when a chronic condition or illness limits a person’s ability to carry out basic activities of daily living (ADLs) such as bathing, dressing, and eating. You may not think of long-term care as an estate planning concern, but the cost of care could quickly erode the value of your estate. Consider these statistics.

- People turning 65 have a nearly 70% chance of needing some form of long-term care in their lifetimes.

- The national median annual cost for a home health aide (44 hours per week) is $54,912.

- The national median annual cost of a private room in a nursing home facility is $105,850.

Sources: U.S. Department of Health and Human Services, 2021; 2020 Cost of Care Survey, Genworth Financial, Inc.

https://calendly.com/freeman-7/free-consultation